- Home

- Complaints & disputes

- Payment withholding request

Payment withholding request

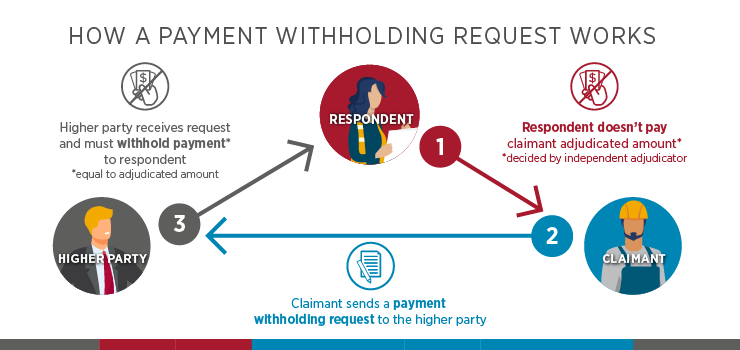

Head contractors and subcontractors who have not been paid an adjudicated amount (amount decided by an adjudicator as owing) will be able to give a payment withholding request to the party that is higher in the contractual chain than their contractor (the higher party). For the head contractor this can be the financier to the principal.

What is a payment withholding request?

A payment withholding request is an option for securing payment if an adjudicated amount (amount decided by an adjudicator as owing) is not paid by the due date.

It requires the party (the higher party) that is higher in the contractual chain than the contractor who owes the adjudicated amount (the respondent) to withhold the requested amount from money that would otherwise be payable to the respondent.

Head contractors and subcontractors who have not been paid an adjudicated amount can use a payment withholding request. For head contractors, a payment withholding request can be given to the financier if they are owed money by the principal.

Payment withholding request information for Adjudication Claimants

When can a payment withholding request be used?

A payment withholding request can only be used when:

- you are the ‘claimant’ (money is owing to you) and you’ve taken the payment dispute through the adjudication process

- an adjudicator has decided in your favour and specified the amount owed to you (the ‘adjudicated amount’) by the other party (the ‘respondent’)

- the respondent does not pay you the adjudicated amount by the due date – which is within 5 business days of receiving a copy of the adjudicator’s decision or by a date decided by the adjudicator.

Identifying a higher party is in the contractual chain

If you are not sure who is the higher party, you can request information about the higher party from the respondent by using an:

The respondent must provide you the following information within 5 business days after receiving the request:

- the higher party’s name and business address (or residential address if there is no place of business)

- information about whether the higher party is liable, under a contract or arrangement with the respondent, for an amount that is payable or will become payable to the respondent for construction work (or supply of related goods and services) related to the adjudicated amount.

Not responding within this timeframe or providing false or misleading information about the higher party are offences and may incur a penalty.

How to use a payment withholding request

Follow these steps to send a payment withholding request:

- obtain all necessary information about the higher party

- complete s97B(2)—payment withholding request (PDF, 78KB) and send to the higher party

- you must also give a copy of the request to the respondent at the same time – failing to do so is an offence and may attract a penalty.

If, after giving a payment withholding request, the respondent pays the adjudicated amount you must notify the higher party of the amount that you’ve been paid within 5 business days. Failing to do so is an offence and may attract a penalty. You can notify the higher party by completing and sending this form:

When a higher party receives a payment withholding request

A higher party who receives a payment withholding request is required to withhold an amount no more than the value of the unpaid adjudicated amount. This can be withheld over more than one payment claim, including from final payment claims and retention amounts.

If the remaining amount the higher party is liable to pay the respondent under the construction contract is less than the unpaid adjudicated amount, the higher party must withhold all the remaining amounts from payment to the respondent.

Here are some examples:

- If the adjudicated amount is $55,000 and the amount payable from the higher party to the respondent is $120,000 – the higher party’s obligation is to withhold $55,000.

- If the adjudicated amount is $55,000 but the amount payable by the higher party to the respondent is only $40,000 – the higher party’s obligation is to withhold $40,000.

Higher parties complying with a payment withholding request are legally protected from recovery action by respondents for the withheld amounts. Additionally, the duration of withholding amounts in accordance with a payment withholding request is not considered when working out any period for which the amount has gone unpaid to the respondent.

If a payment withholding request is given to a person who is NOT or NO LONGER the higher party (i.e. because the contract has ended or all liable amounts have been paid), they must notify the claimant that they are not the higher party within 5 business days after receiving the request. Failing to do so may attract a penalty. Use this form:

Consequences for not complying with payment withholding request

There are serious consequences for higher parties who fail to comply with payment withholding requests.

The higher party and the respondent will become jointly liable to pay the adjudicated amount to the claimant if the higher party fails to comply with a payment withholding request. The higher party can however recover – as a debt from the respondent – any amount the claimant recovers from them.

Payment withholding request information for higher party