- Home

- Licences

- Licensing reforms

- Building Reg Reno

Deconstructing the Building Reg Reno

Understand upcoming regulatory changes and what they mean for you

On 10 February 2025, the Queensland Government introduced the Building Regulation Renovation (Building Reg Reno) which will roll out regulation changes gradually through a series of tranches.

Use the reform checker to see if a licence you hold is affected by the Building Reg Reno and read on below for more detail about what this means for you and your business.

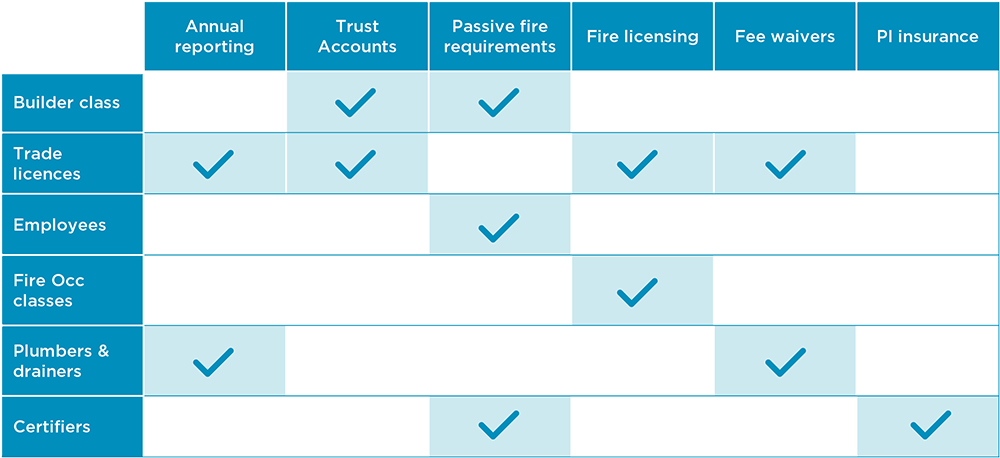

At a glance

The below table shows reforms in Tranche 1 & 2 of the Building Reg Reno, and which licence types are impacted by the changes.

Reform checker

Select a licence type via the buttons below to see the relevant changes releasing in Tranche 1 & 2 of the Building Reg Reno.

Click on the reform types below to learn what is changing and confirm what this means for your ongoing regulatory obligations.

-

What changes

Sole traders who hold an individual QBCC licence in their own name will no longer have to provide annual financial reporting, provided their approved maximum revenue is under $800,000—financial categories SC1 and SC2.

What stays the same

There is no change in annual reporting obligations for QBCC licensed companies. Companies have an ongoing requirement to comply with the relevant annual financial reporting requirements for their category, regardless of revenue.

SC1 and SC2 sole traders continue to have other minimum financial requirements (MFR) as part of their licensing obligations.

Ongoing MFR requirements include:

- ensuring you maintain sufficient working capital to operate your business —net tangible assets

- having sufficient current assets to discharge all current liabilities —current ratio

- not exceeding your maximum revenue —maximum revenue (MR)

For more information about MFR obligations for QBCC licensees, visit our What is minimum financial requirements webpage.

-

What changes

Future phases of the trust account framework planned for 1 March and 1 October 2025 have been paused. This means the lower contract thresholds, due to be applied as part of these phases (1 March eligible contracts valued at $3M or more, 1 October eligible contracts valued at $1M) will not occur.

What stays the same

No changes have been made to trust account phases already implemented (as part of Tranche 1, 2 and 3 of the Building Reg Reno). Further changes have been earmarked for Tranche 4, and we will provide further information once this is available.

Trustees with current and ongoing eligible contracts, continue to have provisions under the framework. These include:

- eligible Queensland Government contracts of $1 million or more

- private sector, local government, statutory authority, and government-owned corporation contracts of $10 million or more.

Trustee obligations include engaging with approved financial institutions for the setting up of trust accounts, record keeping and accounting responsibilities and requirements for beneficiary payments.

Information about trust account criteria, trust account creation and management of a trust account is available on our Planning a trust account and Operating a trust account webpages.

For more information about other payment protections, visit our Getting paid webpage.

-

What changes

The date for builders to be compliant with the licensing changes for passive fire, brought in by the 2021 Fire licensing framework reforms, has been extended from 1 May 2025 to 1 May 2030.

What stays the same

All other licensing changes brought in by the Fire protection licensing framework have been commenced. A detailed breakdown of these changes can be found on our Passive Fire webpage.

-

What changes

The 1 May 2025 deadline provided to fire protection licensees identified with upskilling requirements following the 2021 Fire licensing framework reforms, has been extended to 1 May 2030.

The small group of fire protection licensees affected by this reform will be receive a letter and email detailing the specific licences and upskilling requirements that apply to them.

What stays the same

This reform makes no further changes to licensing conditions or requirements for these fire protection licensees.

-

What changes

The Building Reg Reno has extended the fee waiver schedule available for certain PD Act occupational licences—where a related QBCC contractor or nominee supervisor licence is also held or is being applied for.

What stays the same

Fee waivers apply to individual licences only, not company licences. Fee waivers are automatically applied at renewal time for existing licensees and at the approved application stage for new licensees.

Check the fee waiver table for the current schedule of fee waivers.

-

What changes

The exemption for certifiers to perform all other private certifying functions, while holding Professional Indemnity insurance with an exclusion relating external cladding work has been extended from 30 June 2025 to 30 June 2027.

What stays the same

This is a continuation of a current exemption that was due to expire. There are no other changes to Professional Indemnity insurance requirements.

-

What changes

Future phases of the trust account framework planned for 1 March and 1 October 2025 have been paused. This means the lower contract thresholds, due to be applied as part of these phases (1 March eligible contracts valued at $3M or more, 1 October eligible contracts valued at $1M) will not occur.

What stays the same

No changes have been made to trust account phases already implemented (as part of Tranche 1, 2 and 3 of the Building Reg Reno). Further changes have been earmarked for Tranche 4 of the reforms, and we will provide further information once this is available.

Trustees with current and ongoing eligible contracts, continue to have provisions under the framework. These include:

- eligible Queensland Government contracts of $1 million or more

- private sector, local government, statutory authority, and government-owned corporation contracts of $10 million or more.

Trustee obligations include engaging with approved financial institutions for the setting up of trust accounts, record keeping and accounting responsibilities and requirements for beneficiary payments.

Information about trust account criteria, trust account creation and management of a trust account is available on our Planning a trust account and Operating a trust account webpages.

For more information about other payment protections, visit our Getting paid webpage.

-

What changes

The date for builders to be compliant with the licensing changes for passive fire, brought in by the 2021 Fire licensing framework reforms, has been extended from 1 May 2025 to 1 May 2030.

What stays the same

All other licensing changes brought in by the Fire protection licensing framework have been commenced. A detailed breakdown of these changes can be found on our Passive Fire webpage.

-

Extension of the exemptions for certain new houses on certain narrow lots and particular small pre-built houses from the Modern Homes standards livable housing design provisions for a further 18 months (until 30 August 2026).

-

What changes

Sole traders who hold an individual QBCC licence in their own name will no longer have to provide annual financial reporting, provided their approved maximum revenue is under $800,000—financial categories SC1 and SC2.

What stays the same

There is no change in annual reporting obligations for QBCC licensed companies. Companies have an ongoing requirement to comply with the relevant annual financial reporting requirements for their category, regardless of revenue.

SC1 and SC2 sole traders continue to have other minimum financial requirements (MFR) as part of their licensing obligations.

Ongoing MFR requirements include:

- ensuring you maintain sufficient working capital to operate your business —net tangible assets

- having sufficient current assets to discharge all current liabilities —current ratio

- not exceeding your maximum revenue —maximum revenue (MR)

For more information about MFR obligations for QBCC licensees, visit our What is minimum financial requirements webpage.

-

What changes

Future phases of the trust account framework planned for 1 March and 1 October 2025 have been paused. This means the lower contract thresholds, due to be applied as part of these phases (1 March eligible contracts valued at $3M or more, 1 October eligible contracts valued at $1M) will not occur.

What stays the same

No changes have been made to trust account phases already implemented (as part of Tranche 1, 2 and 3 of the Building Reg Reno). Further changes have been earmarked for Tranche 4 of the reforms, and we will provide further information once this is available.

Trustees with current and ongoing eligible contracts, continue to have provisions under the framework. These include:

- eligible Queensland Government contracts of $1 million or more

- private sector, local government, statutory authority, and government-owned corporation contracts of $10 million or more.

Trustee obligations include engaging with approved financial institutions for the setting up of trust accounts, record keeping and accounting responsibilities and requirements for beneficiary payments.

Information about trust account criteria, trust account creation and management of a trust account is available on our Planning a trust account and Operating a trust account webpages.

For more information about other payment protections, visit our Getting paid webpage.

-

What changes

The 1 May 2025 deadline provided to fire protection licensees identified with upskilling requirements following the 2021 Fire licensing framework reforms, has been extended to 1 May 2030.

The small group of fire protection licensees affected by this reform will be receive a letter and email detailing the specific licences and upskilling requirements that apply to them.

What stays the same

This reform makes no further changes to licensing conditions or requirements for these fire protection licensees.

-

What changes

An extension of the current fee waiver schedule for occupational licences has been announced by the government. Once the details of these changes are confirmed, all new fee waivers will be applied for eligible existing licensees and applicants.

What stays the same

Fee waivers are already in place for certain PD Act occupational licences where a related QBCC contractor or nominee supervisor licence is held or is being applied for.

The current fee waivers are automatically applied at renewal time for existing licensees and at the approved application stage for new licensees. Check the fee waiver table for the current schedule of fee waivers.

-

What changes

The date for builders to be compliant with the licensing changes for passive fire, brought in by the 2021 Fire licensing framework reforms, has been extended from 1 May 2025 to 1 May 2030.

What stays the same

All other licensing changes brought in by the Fire protection licensing framework have been commenced. A detailed breakdown of these changes can be found on our Passive Fire webpage.

-

What changes

The 1 May 2025 deadline provided to fire protection licensees identified with upskilling requirements following the 2021 Fire licensing framework reforms, has been extended to 1 May 2030.

The small group of fire protection licensees affected by this reform will be receive a letter and email detailing the specific licences and upskilling requirements that apply to them.

What stays the same

This reform makes no further changes to licensing conditions or requirements for these fire protection licensees.

-

What changes

Sole traders who hold an individual QBCC licence in their own name will no longer have to provide annual financial reporting, provided their approved maximum revenue is under $800,000—financial categories SC1 and SC2.

What stays the same

There is no change in annual reporting obligations for QBCC licensed companies. Companies have an ongoing requirement to comply with the relevant annual financial reporting requirements for their category, regardless of revenue.

SC1 and SC2 sole traders continue to have other minimum financial requirements (MFR) as part of their licensing obligations.

Ongoing MFR requirements include:

- ensuring you maintain sufficient working capital to operate your business —net tangible assets

- having sufficient current assets to discharge all current liabilities —current ratio

- not exceeding your maximum revenue —maximum revenue (MR)

For more information about MFR obligations for QBCC licensees, visit our What is minimum financial requirements webpage.

-

What changes

An extension of the current fee waiver schedule for occupational licences has been announced by the government. Once the details of these changes are confirmed, all new fee waivers will be applied for eligible existing licensees and applicants.

What stays the same

Fee waivers are already in place for certain PD Act occupational licences where a related QBCC contractor or nominee supervisor licence is held or is being applied for.

The current fee waivers are automatically applied at renewal time for existing licensees and at the approved application stage for new licensees. Check the fee waiver table for the current schedule of fee waivers.

-

What changes

The date for builders to be compliant with the licensing changes for passive fire, brought in by the 2021 Fire licensing framework reforms, has been extended from 1 May 2025 to 1 May 2030.

What stays the same

All other licensing changes brought in by the Fire protection licensing framework have been commenced. A detailed breakdown of these changes can be found on our Passive Fire webpage.

-

What changes

The exemption for certifiers to perform all other private certifying functions, while holding Professional Indemnity insurance with an exclusion relating external cladding work has been extended from 30 June 2025 to 30 June 2027.

What stays the same

This is a continuation of a current exemption that was due to expire. There are no other changes to Professional Indemnity insurance requirements.

More information

You can learn more about the Building Reg Reno on the Department of Housing and Public Works’ website.

- Licensing reforms

- Building Reg Reno

- Fire protection upskilling requirements

-

- New fire protection framework

- Certify classes changes

- Emergency lighting licence changes

- Fire detection, alarm & warning system licence changes

- Sprinkler and suppression systems licence changes

- Fire hydrants, hose reels & pumps licence changes

- Fire safety professional licence changes

- Changes to portable fire equipment licences

- Passive fire licence changes

- Special hazard suppression systems licence changes